Do you live in the U.S. and own cryptocurrency? Have you filed it on your taxes? If you haven’t -- or misreported how much -- there’s some serious risks ahead. The IRS has just published a whole slew of new guidelines -- so excuses like “I didn’t know I had to report” or “I didn’t know how much to report” -- are drying up fast.

Do you live in the U.S. and own cryptocurrency? Have you filed it on your taxes? If you haven’t -- or misreported how much -- there’s some serious risks ahead. The IRS has just published a whole slew of new guidelines -- so excuses like “I didn’t know I had to report” or “I didn’t know how much to report” -- are drying up fast.

The Internal Revenue Service agency’s 2014 guidance didn’t answer all relevant questions. And, unfortunately, the crypto market has become far more complex in the last few years.

Below you’ll find a few key points in summary. If you’d like to know more please visit the IRS site.

The Internal Revenue Service agency’s 2014 guidance didn’t answer all relevant questions. And, unfortunately, the crypto market has become far more complex in the last few years.

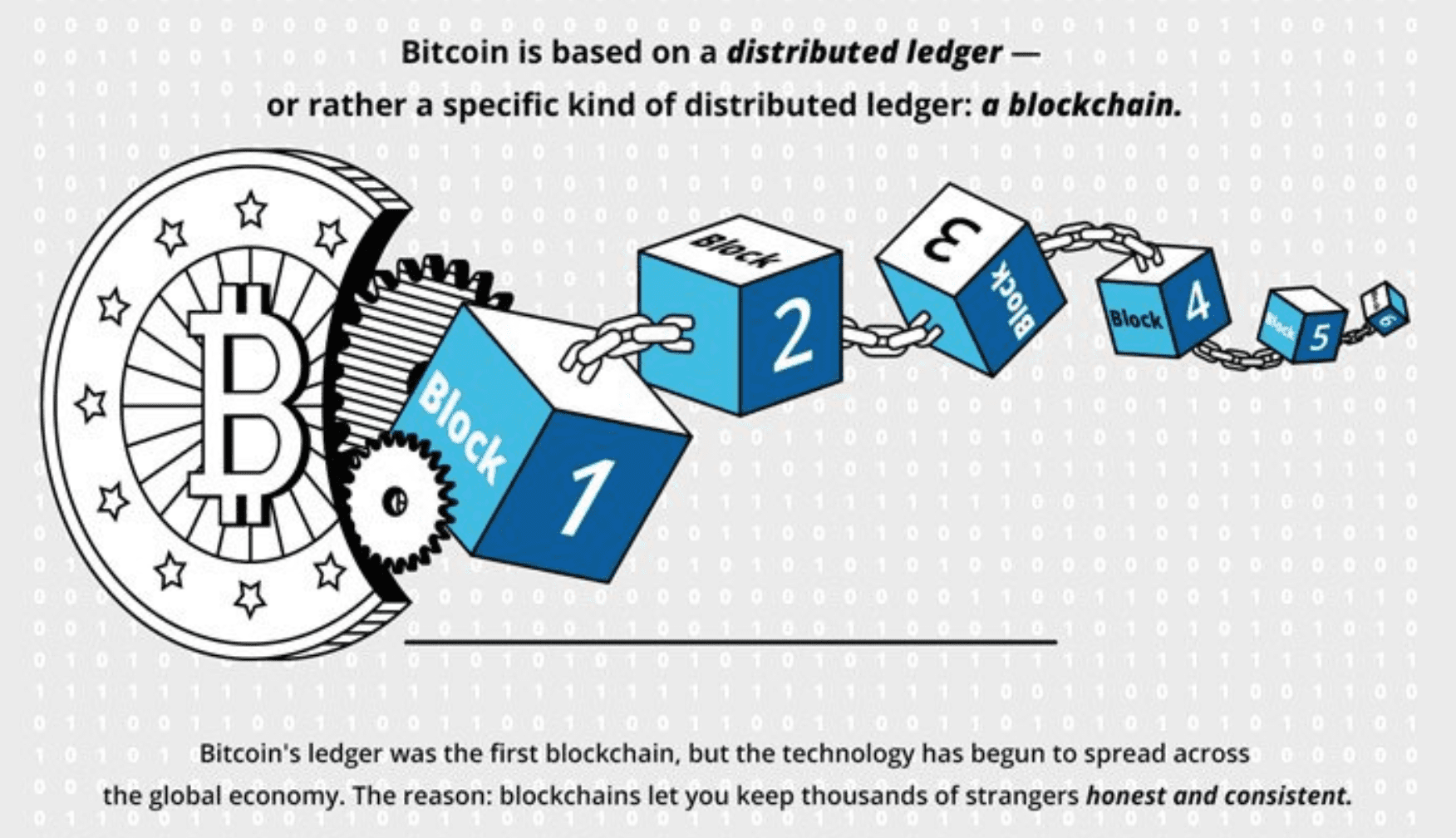

Some highlights are: the tax liabilities created by cryptocurrency forksFork

A change in the original code of a software.

Hard Forks

Raise your hand if you held BTCBitcoin

The first blockchain-based cryptocurrency, launched in 2009. Bitcoin remains the most influential and widely recognized coin. All other cryptocurrencies are known as "altcoins," simply because they are not Bitcoin.

Bitcoin Cash

The first successful hard fork of Bitcoin that allows the protocol to grow and scale by removing its block size limit.

The new guidance says new cryptocurrencies emerging from a fork of an existing blockchain should be treated as “an ordinary income equal to the fair market value of the new cryptocurrency when it is received.”

In other words, you’ve incurred tax liabilities as soon as the new cryptocurrencies are recorded on a blockchain. Of course, you need to have control over the coins and the ability to spend them. If an exchange took all your hardfork coins and kept them -- no issue.

The document reads:

“If your cryptocurrency went through a hard fork, but you did not receive any new cryptocurrency, whether through an airdrop (a distribution of cryptocurrency to multiple taxpayers’ distributed ledger addresses) or some other kind of transfer, you don’t have taxable income.”

In short, you’ll be assessed income when you receive the asset.

Cost basis / Fair Market Value

The new IRS document also gives clarification on how you and other taxpayers can determine the cost basis, or fair market value of coins from a salary, miningMining

The process by which new coins are created as transactions on a network are verified.

First, you’ll want to sum up all the money spent to get your crypto, “including fees, commissions and other acquisition costs in U.S. dollars.”

Then determine the cost basis of each unit of crypto disposed in a taxable transaction (such as a sale of a mining rig in exchange for crypto).

This is helpful because you might buy bitcoin in multiple transactions -- sometimes over a span of years. When you sell it, which purchase price should you use for calculating taxable gains?

If you buy your crypto on a peer-to-peer exchange or a DEXDEX

Decentralized exchange. A platform (which isn't controlled by any single authority) that allows users to buy and sell cryptocurrencies.

When selling your crypto, you can identify the coins you are selling, “either by documenting the specific unit’s unique digital identifier such as a private keyPrivate Key

Private keys are used to spend cryptocurrencies.

Public Key

An address that individuals share with others to receive cryptocurrency.

This information, the document states, should list:

“(1) the date and time each unit was acquired, (2) your basis and the fair market value of each unit at the time it was acquired, (3) the date and time each unit was sold, exchanged, or otherwise disposed of, and (4) the fair market value of each unit when sold, exchanged, or disposed of, and the amount of money or the value of property received for each unit.”

The new guidance goes on to state that it allows for “first-in, first-out” accounting. Or you can specify when the cryptocurrencies being sold were bought.

So for example, if you bought 1 crypto at $5,000 and a second crypto at $2,000 but then sold one -- you can either identify the unit and trace its original price or use ‘first-in, first-out.” The first in and first out method means sometimes you can show a capital gain and sometimes you can show a loss.

Finally

If you like to spend your coins on everyday purchases like cups of coffee, the IRS specifically asks you to report each and every transaction.

Even a cup of coffee must be reported as a capital gain or loss, which should be calculated as “the difference between the fair market value of the services you received and your adjusted basis in the virtual currency exchanged.”

Yes, that is quite burdensome. But what can we do? It’s the IRS.

- Own a website? Link to this article!

- Willing to spread the love? Share it on social!