Is Cryptocurrency a Good Investment

Written by

Senior Writer

This site contains affiliate links. If you click on one, we may earn a commission.

Is Cryptocurrency a good investment?

The crypto market has seen increased media coverage and massive returns in the past couple of years.

You read stories of people becoming millionaires by investing in Bitcoin, Dogecoin, or other altcoins.

You also see plenty of naysayers in the media and traditional finance world saying crypto is a giant bubble waiting to burst, or that the best time to invest is long gone.

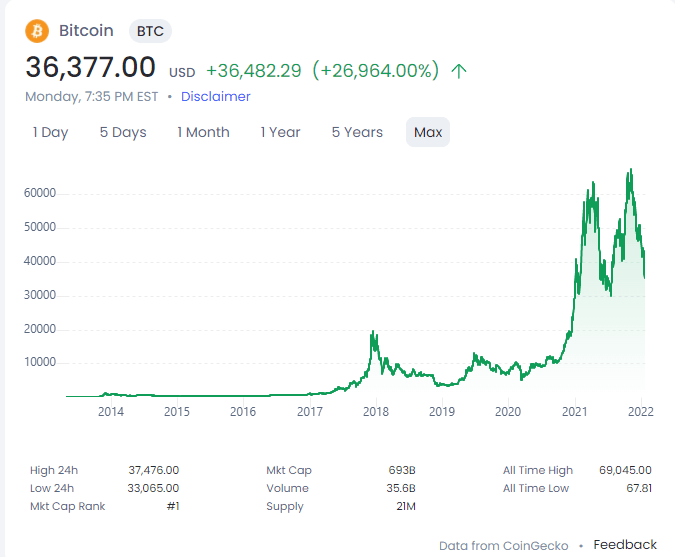

If you look at historical returns, Bitcoin has been a great investment. Many of the major cryptocurrencies follow a similar pattern - huge increases in price followed by crashes with an overall upwards trend.

Of course, past performance is not a prediction of future gains, but crypto is only seeing more widespread adoption among investors, financial institutions, and even governments.

There are several ways to make money with cryptocurrency. You can, of course, buy crypto and sell later when the price appreciates. But there are also ways to hold the coin and earn more, including staking, lending, and Decentralized Finance (DeFi).

These options require minimal effort and carry 5 to 10% interest rates, up to 100 to 200%, with certain DeFi programs. This is on top of however much the coin appreciates over time.

Innovation

Many are drawn to cryptocurrency for its innovations- decentralized, secure, fast, and borderless transactions. Cryptocurrency and blockchain are at the forefront of Web 3.0, where you need not worry about Meta or Google spying on your internet activity and selling your data.

Deciding whether an investment is good is solely based on if you think the price will increase over time. Our current monetary systems are antiquated, slow, and centralized. When you think of banks and governments, innovation is the last word you would use to describe them.

Cryptocurrency’s future role as mainstream money can take several forms. Maybe Bitcoin and Ethereum will be legal tender. Or stablecoins like USDC or Tether, and central bank digital currencies (CBDCs) will become ubiquitous.

Either way, investing in crypto is a future-proofed bet.

Volatility and Risk

Of course, all investing carries risk, and investing in a newer asset class like crypto carries more risk, largely due to a lack of regulatory scrutiny.

Many initial coin offerings have been scams where the project developers sell their large amount of coins, causing the price to crash and all other investors to lose money.

Rug pulls like this are common in DeFi as well, where the developers may be anonymous and not a lot of information is shared with investors.

Other risks are taken on when purchasing crypto. For example, an influential company like Tesla accepting Bitcoin or Dogecoin for payment can cause huge price swings for the crypto, even though the said company is not involved with crypto development or investing.

Cryptocurrency has always been volatile, and likely will be for some time. Twenty-four-hour price swings of 10 to 20% happen even for the largest market cap coins like Bitcoin and Ethereum. Altcoins can experience ever larger price swings. Crypto is highly liquidable, but you may need to wait weeks or months for volatility to settle.

Cryptocurrencies are unique since you are buying a currency, not a share of a publicly-traded company. Your returns are not tied to the performance of a said company, but the crypto is not insulated from the actions of companies, countries, or broader market trends.

Although cryptocurrencies are decentralized, centralized authorities like governments can directly influence the price of crypto, as China did when they kicked out all Bitcoin miners in 2021. This caused the entire crypto market to crash as the miners relocated, and many sold Bitcoin out of fear.

There’s also the risk of losing your coins or being hacked. Decentralization carries the risk of you bearing 100% responsibility for your transactions, passwords, and data security.

There’s a saying of “not your keys, not your coins.” Without possession of your private wallet key, like with a Trezor wallet, you carry a risk of losing your coins.

Buy the Dip

A common saying in the crypto community is ‘buy the dip,’ meaning to buy more coins when prices fall. When you do this, you accumulate more crypto for a discounted price. Future volatility is a guarantee, and the best way to cope is to buy the dip!

Cryptocurrency is undoubtedly the future of money in one form or another. Returns of 1,000-10,000% today are unlikely compared to investors from the early days, but it’s never too late to invest and make money.

This article should not be taken as investment advice. As with all investing, invest only what you can afford to lose.