Nexo Review 2023: The Future Of Lending?

Let’s get one thing straight: this 2023 Nexo review focuses on one thing -- profit.

The cryptocurrency space has developed a new type of service over the past couple of years: borrowing and lending cryptocurrencies.

Borrowers can use the extra finances for business endeavors or other profit motives, while lenders earn profit from lending their crypto.

But of course, none of this means anything if your money isn’t safe -- if the platform shuts down, gets hacked, or other unfortunate events.

In this Nexo review, I will examine Nexo from every perspective -- so both lenders and borrowers can make an educated decision whether or not they’ll earn profit with Nexo.

Disclaimer: This article is for informational purposes only. Always do your own research.

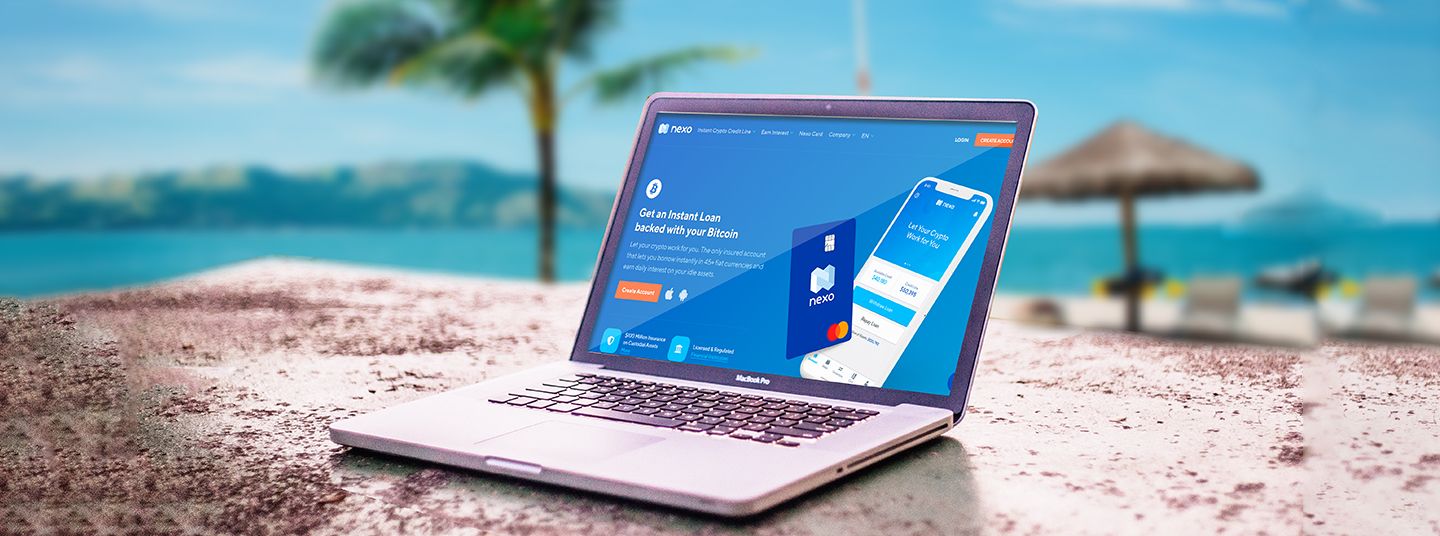

What is Nexo? The Big Picture

To understand what Nexo is -- we must understand where Nexo came from.

Nexo is a subsidiary of Credissimo.

No, Credissimo isn’t a fancy Italian word for credit -- it’s just the way the founders chose to spell the company when they first launched in 2007.

Credissimo still exists. They are a leading fintech group serving millions of people across Europe since 2007.

This is the main reason to trust Nexo in the first place. It’s backed and operated by an experienced company that has been helping customers lend and borrow money for over 10 years.

Source: Nexo YouTube ChannelNexo launched in 2018. Just seven months after its launch, Nexo established itself as the world’s leading crypto lending service. Since then, they have processed more than $300 million. Their user base has also grown beyond 170,000 active customers.

There has been no breach or significant defaults on the crypto loans since 2018. This is probably because the loans are generally overcollateralized -- which helps during the wild volatility of crypto markets.

Nexo has the largest network in the cryptocurrency space. It is the most advanced instant crypto lending provider on a global scale. And it truly is a global scale, since they service 45+ currencies across more than 200 jurisdictions, including all the laws that go into making a financial service legal and operable in those jurisdictions.

The Company & Team

Nexo has an award-winning team whose business has continuously been audited by Deloitte. That counts for a great deal, especially in the cryptocurrency space where it’s rare to see a company ask for and value the advice from an external auditing company.

The team behind Credissimo is the one that transitioned to lead Nexo Lending. You know what that means? Adaptability.

Credissimo was formed in 2007 and grew as a company while Satoshi Nakamoto

was still writing the Bitcoin whitepaper. So when the team behind Credissimo saw bitcoin and blockchain tech popup, they knew it would be the future of finance. Good on them for the transition.Satoshi Nakamoto

The anonymous person or group that created Bitcoin.Since then, they’ve reached the Top 10 Alternative Finance in European FinTech Awards 2017. Plus two Forbes Business Awards in 2017 for "Financial Sector Innovations" and "Quality of Services."

Now the team provides instant loans to millions of people across Europe and expanding to even more regions that I’m sure this Nexo review isn’t big enough to cover. By the way, if you want to find more about the legitimacy of Nexo or other cryptocurrency companies, make sure to check this website.

Anyway, Nexo does this by providing the world's first Instant Crypto-backed Loans. All thanks to the team behind Nexo Lending identifying and successfully solving inefficiencies on lending markets by applying blockchain technology.

Along the way, Nexo has acquired Bitgo as a strategic partner, Onfido as a compliance partner, and become a part of the Swiss finance and technology association.

If all that isn’t impressive in such a short amount of time -- then I don’t know what else I could possibly add to this Nexo review. That’s the top!

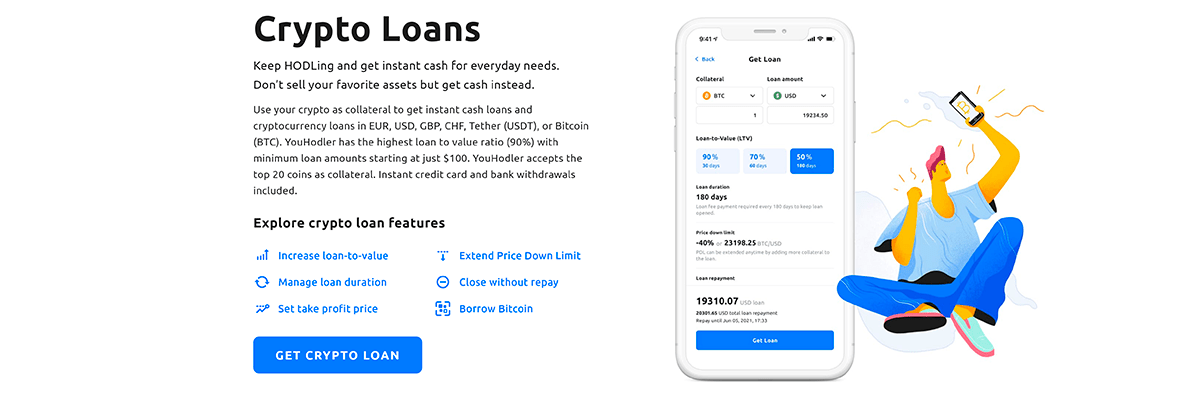

Borrowing Through Nexo? Worth It?

Remember the goal of this Nexo review? Profit. If you are borrowing through Nexo, then you don’t want to lose too much on interest. So let’s take a look at Nexo’s borrowing service.

Use Of Collaterals

In order to secure a loan on Nexo, you must first deposit collateral that will be used by Nexo as a security deposit to repay the loan, if you fail to do so.

Source: nexo.io

The cryptocurrencies currently available to serve as collaterals are:

- Bitcoin (BTC)

- Ether (ETH)

- XRP

- Litecoin (LTC)

- NEXO Tokens

- Binance Coin (BNB)

- Stellar (XML)

- EOS (EOS)

Keep in mind that new collateral options are being added regularly. You can even vote on which coins should be added.

Your crypto assets are then held in multi-signature wallets and cold storage. How secure are these, you may ask?

Well, the cold storage is at Goldman Sachs-backed, SEC-approved custodian BitGo. PrimeTrust, an SEC-approved custodian, also secures your deposits.

Borrowing Limit

If you need, you can increase your loan limit by depositing more crypto into your Nexo Wallet.

Because remember, your loan is approved based on how much collateral you put up. You can choose to borrow as little as the minimum loan amount of $500 and as much as their maximum limit of $2,000,000.

Your loan limit is dynamically determined by the Nexo Oracle algorithms. They take into account the current and historical volatility and market liquidity of the particular assets you plunked down as collateral -- and give you a loan limit based on all those factors.

This loan limit, or loan-to-value (LTV) ratio, ranges from 20% to 50% of the assets you deposited. As an example: If you stake $10,000 worth of Bitcoin, you will be able to withdraw an instant loan of approximately $5,000 (in fiat or other), which would give you an LTV of 50%.

Nexo Lending goes as far as to let you deposit a mix of assets -- and the LTV ratio will be determined based on this mix of assets.

Obtaining Your Loan

One thing to note in this review of Nexo is the word “instant.”

Remember that Bitcoin network transactions need six network confirmations

to appear in your Nexo Wallet.Confirmations

Verifications of consensus by miners and/or nodes. After an individual sends payment on a blockchain, confirmations are required before the recipient can accept payment.So “instant,” of course, depends on which blockchain you are using and how fast it is. ETH

and ERC20Ether (ETH)

The native tokens of the Ethereum platform. Required in order to send transactions or execute smart contracts.deposits will appear after 50 network confirmations, which is often a similar amount of time. You can keep track of the status on the Transactions page.ERC20

The predominant standard for creating smart contracts on the Ethereum blockchain. Others may include ERC 721, ERC888, and moreBut it’s worth it -- because no credit check is required, there’s no loan application to fill out or long waiting for approval. Nothing. You can just deposit and get a loan right then and there.

Source: imgflip.com

If you choose to withdraw your loan in USDT

or another stablecoinUSDT

The acronym for stable coins issued by Tether Limited: U.S. Dollar Tether., you will be able to withdraw instantly to the crypto wallet or exchange of your choice.Stablecoin

Any cryptocurrency pegged to a stable asset for the purpose of reducing price volatility.Of course, if you choose fiat

withdrawals, it won’t be instant. With bank transfers, you will generally receive your funds within 2 business days (up to 5 business days if it is a USD withdrawal to a non-US bank account).Fiat

Paper money issued by governments as default currency. The US Dollar, Japenese Yen, Chinese Yuan, and Euro are all fiat currencies.So now that you know how that works, let’s dive into the numbers. See if it’s profitable for you.

Loan Terms

The annual percentage interest rate (APR) starts at 8%, which is quite low compared to your average credit card rate of 12% to 24% or more.

Thankfully, interest is charged only for the days you borrow and on the money you use. So if you don’t withdraw everything from the Nexo platform, then you won’t be charged.

No minimum loan repayments are required. The interest is debited automatically from your available credit limit and collateral you have deposited.

Using an example should help make this Nexo review clearer.

You want to buy a $10,000 motorcycle. Instead of selling your Bitcoin -- and missing out on all the sweet appreciation it could be making, you instead opt to get a crypto-backed Nexo loan.

Loan Limit: $10,000.

Deposit Required: $20,000 worth of bitcoin (or more using another cryptocurrency). This deposit is always yours.

Interest: begins at 8% per year APR.

Daily Interest: ~$2.22 which is debited each day from your available assets

That simple. And when you are ready, you can repay all or part of your loan at any time. Just bank transfer it or use crypto -- you can even use the assets deposited in your Nexo Wallet.

You gain access to instant cash and get to HODL through the upswings and downswings.

Plus, bonus, selling crypto assets at a profit triggers a tax event -- borrowing against them does not. So you save on taxes.

Nexo Borrowing: Features

Nexo is loaded with useful features. The best is that you can borrow instantly in 45+ fiat

currencies. This helps if you’re a resident in and outside the E.U., or if you’re traveling and need a quick loan of the local currency.Fiat

Paper money issued by governments as default currency. The US Dollar, Japenese Yen, Chinese Yuan, and Euro are all fiat currencies.Another essential point to mention in this review of Nexo is the $100 million insurance on custodial assets -- which means your assets stay safe. Especially since Nexo is licensed & regulated.

And to put the highlights on top: since the loan is backed by collateral, it’s guaranteed approval with no credit check. And no hidden fees to frustrate you either.

Borrowing on Nexo: Pros and Cons vs. Competition

Pros

- More fiat currencies to borrow (45+) than the competition

- High insurance coverage ($100 million)

Cons

- Not as low interest rate as competitors. It starts at 8% -- but some competitors charge less interest than this. Granted, they are also not as safe. But the choice is up to each of us.

Earning Interest With Nexo Lending? How Much?

Here’s where this Nexo review really digs into the potential for profits.

Say you’ve got a bit of a nest egg, right? You’ve made a windfall in crypto.

What do you do? What if you don’t have enough for real estate or a small business -- but you still want to earn from what you have saved.

Well, you could plow it back into unknown altcoins and hope for the best. But what if you want to keep a portion of your savings in something less risky?

Of course, a bank like Deutsche Bank only offers 0.5% per year. Most banks only offer 1 to 3% on a savings account -- which just barely keeps up with inflation.

Nexo lets you earn up to 8% per year.

Through the Nexo platform, lenders can earn interest on their stablecoins. After setting up a Nexo Wallet, you can deposit stablecoins (DAI, PAX, USDC, USDT & TUSD) or fiat currencies (USD, EUR, GBP).

This earns you compounding interest paid out daily. It’s a fully automated process available for all Nexo Wallets with no minimum amounts & no fees restrictions.

And rest assured, because once again, these deposits are insured up to $100M.

You don’t even need to lock up your money for a fixed period. Feel free to add and withdraw funds at any time with no fees and commissions.

To help out, Nexo is using Onfido to adhere to KYC and AML standards. Remember, Onfido is also trusted by Coinbase, Revolut, HSBC, Nationwide, TransferWise and Bittrex.

So if you use one of these other services -- then your trust in them may match your trust in Nexo.

You may also wonder: Does Nexo accept non-stablecoins deposits?

Unfortunately, they don’t for now. And this somehow makes sense.

Indeed, how would the interest be calculated from a coin that fluctuates every hour of every day?

Our Readers Also Love: The 3 Best Bitcoin Lending Platforms To Earn InterestNexo Lending Features

Nexo partners with Bitgo to secure all your crypto assets in cold wallets. BitGo is insured by Lloyd's, backed by Goldman Sachs and is CCSS Level 3 and SOC 2 compliant -- which is fancy speak for iron-clad.

So you and your money should be safe. Which is a good thing, considering your money is compounded daily and paid out daily too -- with no fees.

Quick refresher course, compounding ensures that every day a larger interest amount is credited into your account -- so the numbers keep rising.

Nexo Lending: Pros and Cons vs. Competition

Pros

- Higher insurance for lenders. Up to $100 million in total.

- Secured with military-grade security with 256-bit encryption and cutting-edge technological advances, as well as 24/7/365 fraud monitoring.

Cons

- Not as high interest as competitors. Some other lending platforms offer up to 12% -- but they balance this out with less security, less flexibility, and more compromise.

- You can’t earn interest off of cryptocurrencies that are not stablecoins.

The Nexo Card - A Good Fit For You?

TenX, Crypterium and Bitpay may have offered crypto cards to cryptocurrency enthusiasts.

But Nexo is unlike any of them because the others convert cryptocurrencies to fiat for every transaction.

Instead, Nexo collateralizes users’ crypto and supplies them with a fiat loan. Nexo did this collateralization before, but now the loans can be used to make purchases at merchants that accept MasterCard.

It works like this: after swiping your card, an oracle confirms you have enough collateral to cover the purchase. The oracle then instantaneously executes a loan and settles the transaction in fiat.

So if you’ve ever wanted a credit card but didn’t want to do anything with your credit history, remember that these cards are available independent of your credit history. The staked collateral reduces default risk, so they make the card available for you.

After all that, you can repay your card or loans in either crypto or fiat. Additionally, minimum payments will be eliminated if the value of bitcoin increases.

And it’s all possible due to the credit line being “dynamic,” -- as the value of your collateralized assets increase relative to the market -- your fiat debts decrease.

But hey, don’t take my word for it. Crypto entrepreneur Brock Pierce (and child star in the 90’s hit film Mighty Ducks) mortgaged a flat in Amsterdam using a $1.2 million line of credit through Nexo.

Features

Remember that with a Mastercard, you can access your credit line worldwide. Plus, like many major credit card companies, Nexo offers instant cashback (5%) on all purchases.

Couple that with their flexible repayment options, free additional virtual cards, payments in local currencies, and no monthly/annual fees -- and we have a great alternative to conventional credit cards.

Source: nexo.io

Pros of the Nexo card

- Manage through the Nexo app. Cards from most competitors do not link the card to an app that you can manage the card with.

- Create free virtual cards. This helps with one-off purchases and gives a bit more privacy than some competitor cards, which only give you the one physical credit card.

- Earn 5% cashback instantly on purchases. It’s like having a 5% off coupon for every single place you go to! Other competitors only offer a basic card.

Cons of the Nexo card

- It’s a Mastercard. It’s not as big or as widely accepted as a VISA card. Though it is much better than an American Express card.

Levels Of Verification

Basic verification is required for loans up to $10,000. You'll be asked to verify your account by entering your personal information and submitting it for review.

Don’t worry about privacy yet, as you won’t be required to upload any documents.

On the other hand, an advanced verification is required for loans over $10,000, to get your Nexo payments card, or after earning a certain amount of dividends.

To complete the advanced verification, you will need to take a photo with your mobile phone or upload an existing copy of either your Passport, Driver’s License, or some sort of national ID card.

Those are the two levels of verification.

My Final Words And Opinion On This Nexo Review

I’m convinced.

I’m convinced that the era of finance is rolling through a revolution -- and Nexo is leading the charge.

Why should I continue with banks if I can now do everything they offer with crypto?

Nexo gives me much better interest rates on my savings, better rates on my loans, and now a credit card I can use in 45+ countries with different fiat systems.

The future of finance is looking more and more like freedom -- and it’s thanks to crypto.

- Own a website? Link to this article!

- Willing to spread the love? Share it on social!