Are you a HODLHODL

First made popular in a post by a drunken Bitcoiner who advocated buying but not selling Bitcoin, it is now a meme to intentionally misspell “hold.” Hodlers see huge potential in the future of a cryptocurrency and don’t plan on selling anytime soon.

Are you a HODLHODL

First made popular in a post by a drunken Bitcoiner who advocated buying but not selling Bitcoin, it is now a meme to intentionally misspell “hold.” Hodlers see huge potential in the future of a cryptocurrency and don’t plan on selling anytime soon.

That said, after markets settle down later this year or 2023, DeFi might be the killer app that blockchain was looking for all along.

And Coinbase -- one of the world’s best cryptocurrency exchanges -- recently integrated DeFi directly into the walletWallet

Software or devices that contain public and private keys for storing cryptocurrencies

“DeFi borrowing and lending apps are “smart contractsSmart Contracts

Agreements between two parties that self-execute when their terms are met and automatically cancel when their terms are not met.

Ethereum

A cryptocurrency created by Vitalik Buterin that runs on Ether (ETH). Ethereum was the first blockchain-based technology to make smart contracts and decentralized applications possible.

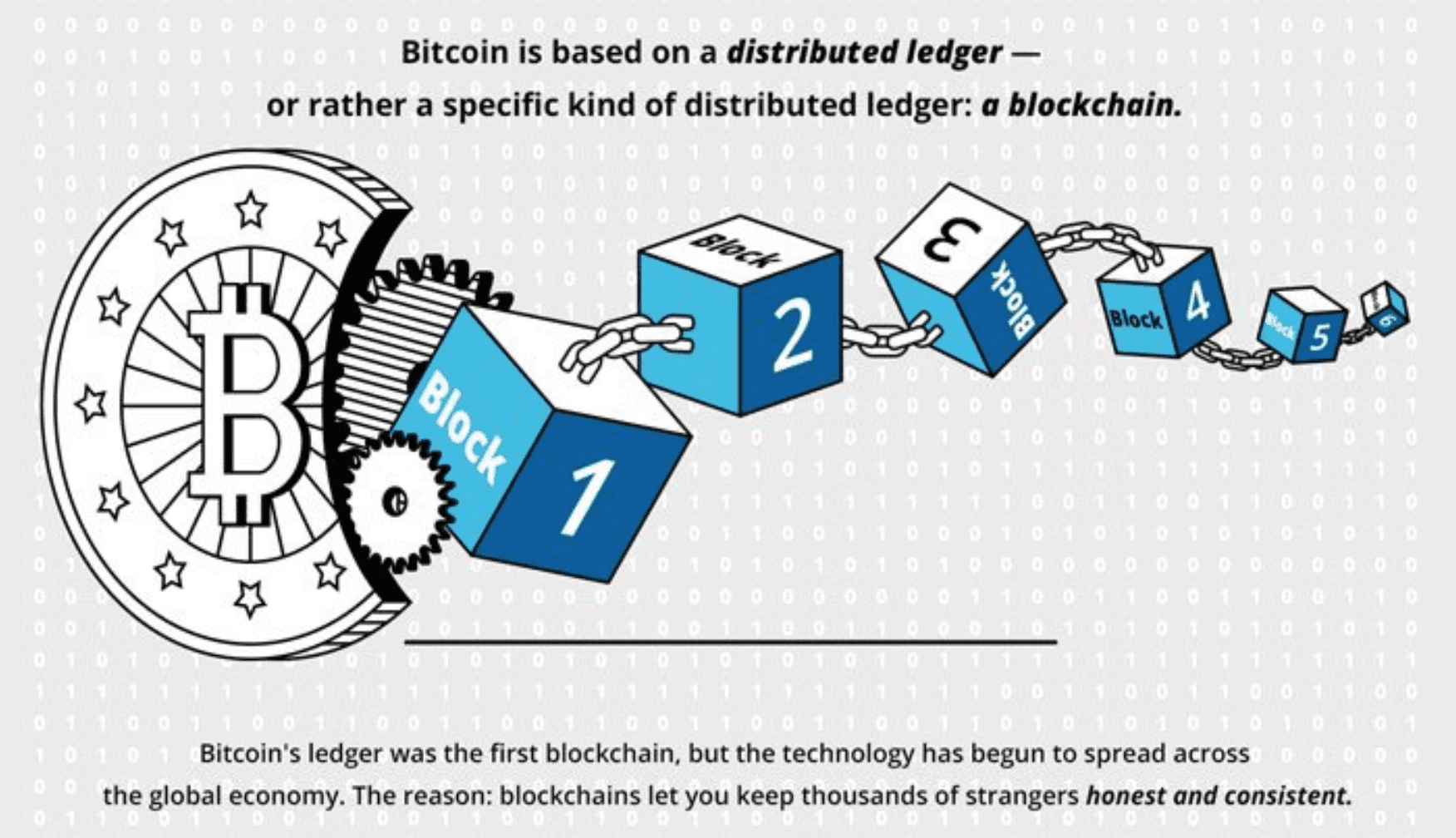

Blockchain

A digital, distributed ledger which contains data for all the transactions that have ever taken place using a given cryptocurrency.

That’s not all. These DeFi loans work because the smart contract guarantees the safety of the lender's crypto. How?

Let’s say you have $1,000 worth of BitcoinBitcoin

The first blockchain-based cryptocurrency, launched in 2009. Bitcoin remains the most influential and widely recognized coin. All other cryptocurrencies are known as "altcoins," simply because they are not Bitcoin.

So, for example, if a borrower wants to borrow that $1,000 from you, they must first lock up $2,000 or more worth of their own cryptocurrency. That way in case the borrower doesn’t repay you or prices fall, the collateral is liquidated and paid to you.

It’s a Win-Win

Both the borrower and lender seem to win from this situation.

Borrowers can HODL. If they have an investment, a car, or bills they need fiat for then they don’t need to sell their crypto. They can put it up as collateral. Then when they repay their loan they can withdraw it.

Lenders can HODL. If they have Bitcoin or other cryptocurrencies they wish to keep for the long haul, then instead of letting them gather dust they can lend them out and earn interest.

As of today, Coinbase is releasing the DeFi option for wallets on iOS. They promise that their Android version will “follow in the coming weeks.”

If you’re ready to go, then you can lend out Ethereum and a bunch of Eth-based tokens such as USDC, DAI, BAT, REP, WBTC, and ZRX. Interest rates are calculated in APR and currently vary from 0.03% to 4.17% APR. The rate depends on several factors: the coin you put up as well as the smart contract terms you’ve chosen.

If it sounds complicated, don’t worry. The DeFi dashboard lets you "compare different rates from providers, easily deposit your crypto without opening a web browser, and view your balances on a simple, unified dashboard."

A word of caution

Do keep in mind that DeFi is a new technology. There are still plenty of problems to resolve. The DeFi volatility which occurred during the recent crypto market plunge rocked the boat and caused some borrowers and lenders to lose money.

That said, after markets settle down later this year or 2023, DeFi might be the killer app that blockchain was looking for all along.

- Own a website? Link to this article!

- Willing to spread the love? Share it on social!