What Is Libra? The Complete Guide to Facebook’s Cryptocurrency

Facebook shocked the world in June 2019 when it announced that it was developing its very own global cryptocurrency called Libra.

So, what is Libra, the facebook currency? And more importantly, why should you care?

Libra is not a usual currency: it is a cryptocurrencyCryptocurrency

Digital currency that uses cryptography. Bitcoin & Altcoins are all types of cryptocurrency.

The Libra project has attracted powerful partners -- from Uber to Visa -- and could very well disrupt our modern economy, from the financial industry to the 2,7 billion users of Facebook’s products.

But how does the facebook currency work? What impact will it have on the economy and the cryptocurrency industry? Should you buy it as an investment, or is it used only as a way to transfer value and make payments?

In this guide, I will answer all the important questions you may have about Libra - the now-famous facebook cryptocurrency.

What Is Libra For Dummies

The word Libra comes from the French word “libre” -- which means free. Libra is also an astrological sign which happens to represent justice, and an ancient Roman unit of weight.

So, Facebook wants to represent freedom, justice, and a unit of weight. However, in reality, the Facebook currency is none of those things.

So, what is Libra?

Libra is a digital currency, like Bitcoin. This means it does not and will not exist in physical form.

Facebook will not print out any ‘Facebucks’ stamped with Mark Zuckerberg’s face (although Verge did it using photoshop). However, it will function as a currency.

Indeed, the Libra currency will be:

- Divisible. Fiatmoney is divisible up to 2 decimal places ($1.00). Libra has not announced how divisible it will be. If it’s anything like Bitcoin it may have 8 decimal places (1.00000000 BTC).

Fiat

Paper money issued by governments as default currency. The US Dollar, Japenese Yen, Chinese Yuan, and Euro are all fiat currencies. - Portable. Fiat money can easily be carried in a wallet. Libra will live on your phone.

- Fungible. Fiat money is all alike. One $100 bill looks and functions like any other $100 bill. Libra coins will all be the same.

Fungibility

The idea that all units in a money supply are exactly equal. Fungibility is considered to be an essential aspect of effective currencies by many economists. - Accepted. Fiat money is accepted in the country you live in. We’ll see where the facebook cryptocurrency is accepted -- but with Facebook’s global reach, it’s certain to be widely used.

- Stable. Fiat money needs to be stable. The U.S. dollar, British Pound Sterling, and Euro are all stable -- they are backed by large and powerful governments. The Libra currency, on the other hand, will not be backed by governments. Rather, it will be backed by a diversified portfolio. We go into detail on this later in the article.

Essentially, that’s what Libra is in a nutshell. Read on to learn the details!

- Divisible. Fiat

What Is Libra Used For?

Coinmarketcap, the biggest cryptocurrency data aggregator, shows an inescapable fact: more than 1,600 cryptocurrencies exist. Some people say over 5,000 cryptocurrencies have been created and destroyed over these last several years.

So why do we need another cryptocurrency, and what makes the Libra currency so special, that it motivates Facebook to pour millions of dollars and thousands of man-hours into developing and deploying it?

Well, the Libra currency might be very useful -- let’s examine its use-cases.

1. Libra as a super stablecoin.

Libra is a stablecoin

— but this Facebook currency is very different from typical stablecoins like USDT, Dai and USDC.Stablecoin

Any cryptocurrency pegged to a stable asset for the purpose of reducing price volatility.Traditionally, a stablecoin gains its stability by being “pegged” or “tethered” to a fiat

currency, like the US dollar, the Euro, etc. A whole mess of complex algorithms goes to work and keep the stablecoin true to its word.Fiat

Paper money issued by governments as default currency. The US Dollar, Japenese Yen, Chinese Yuan, and Euro are all fiat currencies.Naturally, this makes stablecoins much less volatile than assets like bitcoin. Indeed, bitcoin is its own entity and will never be pegged to anything -- like gold.

But what if the U.S. dollar fluctuates? What if the current political tensions mess up the value of the Euro?

Enter Libra.

The Facebook currency will not be pegged to one specific currency; instead, Facebook plans to peg Libra to a group of “of low-volatility assets, including bank deposits and government securities” in multiple currencies.

Josh Constine at Techcrunch explains how Libra works: “The Libra’s value is tied to a basket of bank deposits and short-term government securities for a slew of historically stable international currencies, including the dollar, pound, euro, Swiss franc and yen.”

2. Libra will be used for cross-border payments.

As a super stablecoin, Libra can be used for remittances -- payments to friends and family overseas.

You may think that’s a small market. But think again.

The Economist reports that remittance is a half TRILLION dollar industry. And what’s the main problem with this industry? It’s expensive.

The Economist also reports that “the fee for sending $200 is about 7.2%, or as much as 9.1% if the money is going to Sub-Saharan Africa (and that ignores the exchange rates).”

Can you imagine? 7.2% of $200 is $14.40 -- that is many hours of backbreaking work for some people.

Since the Libra currency has many properties of a cryptocurrency, it might be borderless, lightning-fast and, most likely, nearly feeless.

This would go a long way to helping underdeveloped nations finish developing; something I believe would benefit us all.

3. Libra will be used for domestic payments

Why look at cross-border payments and remittance, and not a bit closer to home?

Services like Venmo are popular for a reason; they allow you to transfer money between your friends and family and business partners within your country -- in the blink of an eye.

These businesses could be disrupted by Libra quite easily.

As of March 31st, 2019 -- there are more than 2.7 billion active daily users of Facebook’s products. That is more than any nation on Earth, and almost as much as America, China and India combined.

Imagine if all these people were given access to a global currency? They could use it to split a bill at a restaurant with their friends, pay their mechanic to fix the car, lend some money to a cousin. It’s incredible.

Put simply, whatever concerns money -- Libra can be used for it. A little scary, isn’t it?

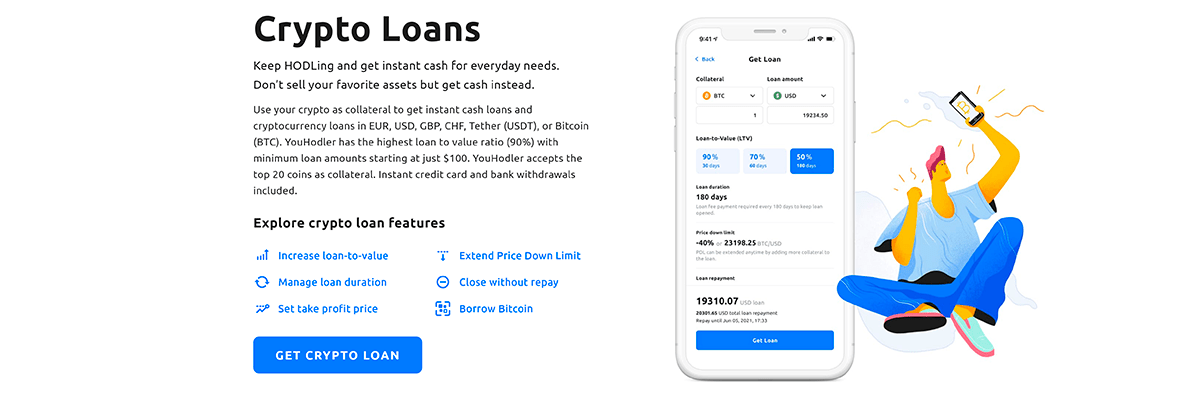

4. Libra for Business

There are no companies or firms who have confirmed accepting the Facebook currency. However, it’s absolutely in the future.

After all, companies who signed up and invested in Facebook’s Libra include Uber, eBay, Lyft, Xapo, and Spotify.

Source: theblockcrypto.com

It makes sense. These businesses, which accept customers around the world, must accept payments in multiple currencies. The firms then need to convert these funds, paying fees and waiting 2-3 days for payments to clear.

If these firms used a standard global currency, such as the Facebook crypto, they would save on fees and transfer times.

Moreover, this could make life easy for customers as well. Imagine traveling to different countries and using Uber. Instead of paying in various currencies, you could pay in one: Libra.

Who is Behind Libra?

Your first reaction may be: “duh, it’s Facebook.” And you are correct.

But what do you know about Facebook? Did you know, for example, that Facebook also owns Instagram and WhatsApp?

As a result, the Libra coin will not only be a Facebook currency -- Libra currency will also be accessible and usable for all Whatsapp users. Whatsapp shows 1.5 billion active daily users.

Who will regulate and control Libra -- the Facebook currency which over 1.5 billion people may begin to use?

The Libra Association.

Facebook established the Libra Association “to oversee the currency, founded by 28 members in Geneva, Switzerland.”

This association is composed of:

- Payment providers (Mastercard, PayPal, PayU, Stripe, Visa).

- Technology and marketplace companies (Booking Holdings, eBay, Lyft, Spotify, Uber).

- Telecommunications giants (Iliad SA and Vodafone).

- Blockchain-based businesses (Anchorage, Bison Trails, Coinbase, Xapo).

- Nonprofit and academic institutions (Kiva, Mercy Corps, Women's World Banking).

The list keeps growing too. An article by Nathan Reiff points out a number of these companies have already signed up to invest $10 million each in Libra. They include “Visa, Inc. (V) and Mastercard, Inc. (MA), digital payments company PayPal Holdings, Inc. (PYPL) and ridesharing powerhouse Uber Technologies, Inc. (UBER).”

These massive sums of money will help launch Libra and, according to Nathan’s report, “Facebook has sought to raise as much as $1 billion in support of the new cryptocurrency project.”

What Benefits for the Members of the Libra Association?

According to the Libra coin’s whitepaper

, this Libra Association of early investors, adopters, and innovators will control, govern, and receive interest from the currencies and investment assets which the Libra organization will hold.White Paper

A technical document that outlines a project’s features, technology, and vision.Will these investors have a say in how Libra works? Possibly. Will they have access to user data? Maybe.

Either way, knowing who is behind Libra is paramount in deciding whether you should use it or not.

But the bottom line is clear: Seeing such big names of Fortune 500 companies, world-leading firms, and especially the diversity of the Libra Association (from Fintech to Nonprofit) is absolutely exciting. The Facebook currency is already disrupting the financial world -- and it’s not even out yet!

Is Libra a cryptocurrency like Bitcoin?

If you compare the Libra currency to the US dollar, the euro, or the yen -- then yes, it is decidedly a cryptocurrency. Why?

- There’s no central bank backing up the Libra coin.

- The Libra currency is built using blockchain technology -- and a public ledger is available.

- Libra coins can be mined-- though only by a few people/firms selected by Facebook.

Mining

The process by which new coins are created as transactions on a network are verified.

Read More: The Ultimate Blockchain For Dummies GuideMatthew Green, an associate professor of computer science at Johns Hopkins University, seems to agree: “It’s fair enough to say the Libra currency uses cryptocurrency technology.” Moreover, he goes on to add: “It’s more restricted in the way the blockchain works, but even that’s not totally unprecedented.”

If you know anything about Bitcoin, you should know what a trustless

system is.Trustless

The ability of a system to be trusted without the need of trusting the individuals with which you are transacting.A trustless system is a system within which users and miners on the network don’t need to trust each other; they agree about transactions not because they trust each other, but because they reach consensus

.Consensus

A general agreement among participants using and mining a cryptocurrency.This idea, so radically different than the need to trust central banks and governments, is one of the pillars behind Satoshi Nakamoto’s 2008 whitepaper.

It means we don’t need to:

- Trust bankers to keep our money safe.

- Trust the government to keep our hard-earned money from hyperinflating.

All we need to do, with Bitcoin and a few other cryptocurrencies, is reach a consensus. Then, what is Libra, and is it similar to Bitcoin?

Libra Isn’t Like Bitcoin

The Facebook cryptocurrency, as opposed to Bitcoin, is permissioned

; it requires trust.Permissioned System

A permissioned system is a private and closed system. Not anyone can join the network freely.Facebook is only allowing a few trusted people/firms/companies to keep track of the Libra ledger.

That means Libra is more like a digital currency (i.e. World of Warcraft gold, Second Life dollars, etc.) rather than a true cryptocurrency.

Lana Swartz, an assistant professor of media studies at the University of Virginia, backs this up when she says: “I actually agree with the folks who’ve been saying that this actually isn’t really a cryptocurrency at all.”

Source: The IBMBlockchain YouTube Channel

What is Libra, then?

It is technically a cryptocurrency for various reasons, including the use of blockchain technology. On the other hand, Libra’s values are very far from the philosophical ideas behind the invention of Bitcoin and other cryptocurrencies -- namely financial freedom from governments and large institutions.

Yet for people who aren’t necessarily looking for financial freedom -- just a way to shoot money on over to their friends and family -- Libra will be an innovative and disruptive solution.

How Does Libra Work?

Serving over two and a half billion people is no small task.

The task becomes ten times more complicated when those billions of people are scattered across nations, cultures, languages, and fiat

financial systems.Fiat

Paper money issued by governments as default currency. The US Dollar, Japenese Yen, Chinese Yuan, and Euro are all fiat currencies.Now that you understand what Libra is, it becomes paramount to understand how the Libra currency works.

The whitepaper sums it up in a brief mission statement: “A simple global currency and financial infrastructure that empowers billions of people.”

But the reality is far more complicated than this one sentence mission statement.

The Libra Economics

So how do the economics around Libra work?

A Techcrunch article attempts an explanation by saying:

“Each time someone cashes in a dollar or their respective local currency, that money goes into the Libra Reserve and an equivalent value of Libra coin is minted

and doled out to that person.”Minting

The process by which users on a PoS blockchain verify transactions and receive new coins for their participation.So, for example, if you buy X Libra for $5.00 -- the Libra Reserve gets your $5 and you get X Libra. Simple enough.

Now we get to the tough part: “If the users cash out from the Libra Association, the Libra coins they give back are destroyed/burned and they receive the equivalent value in their local currency back.”

So, let’s say you’re done using Libra, and you want your money back. You give back to the association X Libra coins -- and they give $5.00 back to you.

Now, what happens with that X Libra coins that the association received?

After all, when you paid $5, the X Libra coins were created for you -- and they held their $5 value for as long as they existed. So now, if you get your $5 back -- the X Libra coins must be destroyed -- otherwise, there will be a duplicate value existing out there somewhere.

That means “there’s always 100% of the value of the Libra in circulation, collateralized with real-world assets in the Libra Reserve. It never runs fractional.“

That’s a big difference from banks.

Because banks, all banks, run fractional reserves. When you deposit $5 into your bank -- any bank, they don’t lock it up somewhere for it to collect dust until you want it back. Instead, they keep a tiny amount, like $0.25 or less, and lend the rest of YOUR money to other people.

That’s why a run on the bank (a surge of individuals withdrawing funds from a financial institution due to fear that the entity will become insolvent in the near future) is so scary. Because if everyone tried to withdraw all their money out at once -- they couldn’t.

Looks like with Libra, this won’t be a problem as they will always hold your money.

Is Libra Decentralized?

Short answer: no. Long answer: maybe.

Source: imgflip.com

Matt Levine explains that “blockchain technology exists to create decentralized money, money that derives its status and value [...] from a combination of (1) computer algorithms that limit and allocate the money and (2) reasonably widespread social acceptance that this sort of thing can be money.”

In a sense, the Facebook currency would be decentralized

. It would find widespread social acceptance in the 2.5 billion + users which Facebook and Whatsapp hold.Decentralized

Distributed amongst its users rather than controlled by one group or within one certain area.But in another philosophical sense, Libra is not decentralized. After all:

- There’s a central Libra Organization.

- There’s only a handful of trusted miners.

Miner

An individual that volunteers computing power to verify transactions on a blockchain in exchange for block rewards. - The founding investors all have a stake and a say.

Which all boils down to the simple fact that if one government (like the U.S.) or a combination of governments (the U.S. and E.U. etc.) were to ban the Facebook cryptocurrency -- they could.

They could round up and arrest all these CEO’s, or seize their offices or the investments Libra holds, or do anything else.

Compare this to Bitcoin, which is truly decentralized and cannot be stopped.

There is no “CEO of Bitcoin,” no investment vehicles or reserve currencies to seize, nothing. Bitcoin cannot be stopped, controlled or altered, while Libra can.

Is Libra Private?

“Is Facebook private? Is WhatsApp private?” No, of course not.

How could it be? You can’t use Facebook privately. To register, you put in your name, email, age, and more.

Even if you made a fake account with a fake name and a fake burner phone number -- the Facebook crypto’s whitepaper stipulates that the Libra Association will comply with all KYC/AML laws in each country it operates in. You’ll only be able to buy, use, and sell Libra if you identify yourself fully and legally.

Simply put: to buy, sell, and trade the Facebook currency -- you’ll need to prove your identity. As a result, the Libra coin isn’t private and can’t be used anonymously.

Why Did Facebook Launch the Libra Cryptocurrency?

Can you believe Facebook is only 15 years old?

That’s right. 15 years ago, Mark Zuckerberg founded Facebook in a Harvard dorm.

Doesn’t feel like it. Feels like Facebook has been around forever. It’s massive. A third of the planet uses it.

Facebook wants to keep it that way by constantly innovating. And what is Libra, if not one of their many innovations?

Disrupting National Currencies

I talked about how Libra will be pegged to a group of low volatility assets. I mentioned how the user base of Facebook and WhatsApp is almost larger than the populations of the top three world nations combined.

But what does this mean for end users like you and me?

Matt Levine, a Forbes columnist, explains about Libra that “its goal is to be more useful than any national currency, accepted in more places and with fewer complications; this is why pegging it to a single national currency would only hold it back.”

Powerful words. Mr. Levine writes that the more people use Libra, the more likely it is to displace national currencies, like the U.S. dollar.

The reason is simple. If you spend mostly Libra -- buying things online, sending money to friends and relatives, etc. -- you’ll start thinking in Libra coins. It’s like learning a second language -- and then thinking/dreaming in it.

If you only need to spend your dollars for occasional costs -- taxes, mortgage, car payment -- then the dollar might become annoying to you.

Adding Another Dimension To Their Offering

Like any large company or nation, Facebook wants to bring as many people under their umbrella as possible.

And what’s something we all need? Money.

I’m not talking about greed. I’m talking about our need for a system of earning, storing, and transferring value.

That’s what money is: a system. Money transforms a mechanic’s hard work into bread and butter. Money made it possible for us to trade our skills for someone else’s skills.

Source: bitcoincasinopro.com

It’s all a system. And if Facebook can make a better, cheaper, or faster system -- then of course, people will use it. It’s a no-brainer.

In the end, Libra is simply another feather in Facebook’s cap. But this one has the potential to be massively disruptive.

How Much Is Facebook Libra Worth?

No hard and fast figures are available for how much one Libra coin will be worth. Those details haven’t been worked out just yet.

Remember this article by Techcrunch which points out: “Each time someone cashes in a dollar or their respective local currency, that money goes into the Libra Reserve and an equivalent value of Libra is minted

and doled out to that person.”Minting

The process by which users on a PoS blockchain verify transactions and receive new coins for their participation.This shows that 1 Libra = 1 Libra. However, right now, it’s anyone’s guess as to how many U.S. Dollars that will be -- or Euro’s, or British Pound Sterling.

Where Can I Buy Facebook Libra?

Eager beaver, huh? Want to nab a few Libra coins as soon as possible? Well, you can’t, not right now anyway.

Facebook has only recently announced their intent to create Libra coin. They still need to build the whole blockchain

it will run on. After that is testing, testing, testing, and then launching.Blockchain

A digital, distributed ledger which contains data for all the transactions that have ever taken place using a given cryptocurrency.Their current estimate is a release in mid-2020. But even if all their tech development goes right -- the Facebook cryptocurrency may take years to release. Why?

Responses From Governments

Facebook announced Libra and its Calibra digital wallet on June 18th, 2019 -- and regulators pounced on it straight away.

U.S. Congress representatives and senate members were in a fury.

Democratic Rep. Maxine Waters, chair of the House Financial Services Committee, said: “Given the company’s troubled past, I am requesting that Facebook agrees to a moratorium on any movement forward on developing a cryptocurrency until Congress and regulators have the opportunity to examine these issues and take action.”

U.S. Federal Reserve Chairman Jerome Powell spoke in front of the House Financial Services Committee -- he explains that Libra, the Facebook currency, raised “serious concerns regarding privacy, money laundering, consumer protection, financial stability.”

Bloomberg reported that Libra would not launch in India. Last year, the country’s central bank banned financial firms from using, dealing with, or having anything to do with cryptocurrencies.

So you see, the road between our fiat

wallets and our Facebook wallets may be a long way off.Fiat

Paper money issued by governments as default currency. The US Dollar, Japenese Yen, Chinese Yuan, and Euro are all fiat currencies.Will Libra Kill Bitcoin?

Many cryptocurrencies have claimed to be Bitcoin-killers, like Ethereum, Tron, or EOS. Not surprising many people wonder if Libra will kill Bitcoin.

The facebook currency will instantly have over two billion users. Why should they use Bitcoin if they have Libra? Why should they learn how to use Bitcoin wallets, private keys, and other technical things if they can use Libra on their Facebook and WhatsApp accounts? With Libra, the future looks grim for Bitcoin…. Or does it?

Libra vs. Bitcoin: Transferring Value

The Facebook crypto will instantly have nearly 2 billion users. You can bet businesses will cater to this massive crowd. Offline and online businesses will both compete to accept Libra and win these customers. This could be game over for Bitcoin. But what if countries like China and India and others ban Libra?

In this article, we’ve examined several things that should give you the answer. The first clue is: Libra is not decentralized

.Decentralized

Distributed amongst its users rather than controlled by one group or within one certain area.It means, simply, that Libra has a business that laws can stop -- and employees that governments can put in jail.

Just like Netflix, right? Netflix cannot operate in certain countries or cities because it is banned or because it chose not to operate there. Similarly, Libra has CEOs and employees -- people that can be sanctioned, fined, or imprisoned. Bitcoin does not.

When I traveled around the world to 20 countries, for 12 months, using only 1 Bitcoin -- I saw first hand the ability of Bitcoin to be an unstoppable system of transferring value. I worked hard for 1 Bitcoin -- it stored my value -- and then I transformed that value into hostels, food, and transportation around the world.

I was able to use my bitcoin in India -- because India cannot stop bitcoin. No country can stop Bitcoin no matter how many laws they pass, because there is no company to shut down and no employees to jail. Like banning gold, banning Bitcoin is next to impossible.

Source: wikipedia.org

But India can stop Libra. All India or any country, state, or city needs to do is ban Libra -- and then everyone there cannot use it anymore.

That said, overall, the facebook currency will be better at transferring value and holding a super stable value. Bitcoin can take a little while to transfer value due to the confirmation process. Libra will most likely be as fast or faster than VISA or Mastercard. Libra will also be stable, unlike Bitcoin which has a fixed supply and therefore must play by the rules of supply and demand.

Libra vs. Bitcoin: Storing Value

I used Bitcoin more like a currency during my travels. I spent it on food, plane tickets, and putting a roof over my head. If, instead, Libra was available -- and more widely accepted than bitcoin -- then yes, I would have used Libra.

But still, there’s a major difference between Libra and Bitcoin: Libra cannot be used as an asset or investment, only as a currency. Why? Because the Facebook cryptocurrency is designed to be a super stable currency. It will be pegged to a global basket of assets. It will also not have a fixed supply (like Bitcoin, which is capped at 21 million).

Bitcoin can be both. People can use Bitcoin to pay for a new Tesla or lock it away until it goes up in value.

If Bitcoin was only used a currency, then sure, Libra could kill it. But many, many people use Bitcoin as an investment, a hedge

, or an asset.Hedging

The act of protecting an asset from risk. A hedge can protect against losses or even offset against gains.These people are banking on Bitcoin to go up, down, and all over the place. These people are making money each time it goes up, and each time it goes down. They can’t do that with a super stablecoin

-- for obvious reasons.Stablecoin

Any cryptocurrency pegged to a stable asset for the purpose of reducing price volatility.

Libra vs. Bitcoin: Final Takeaway

Even though Facebook’s Libra coin and Bitcoin are both viewed as cryptocurrencies -- they serve different purposes. Moreover, there’s room in the world for both. Just like people use fiat

currencies AND gold -- so too they can use Libra and Bitcoin.Fiat

Paper money issued by governments as default currency. The US Dollar, Japenese Yen, Chinese Yuan, and Euro are all fiat currencies.Read more: The 5 Best Ways to Buy BitcoinFinal Takeaway: What Libra Means for Cryptocurrency Adoption

Libra coin, the now-famous Facebook currency, will not kill Bitcoin. It may not even lift off the ground -- if too many politicians suffocate it.

But Libra will do one thing: it will bring the world many steps closer to mass cryptocurrency adoption.

When Facebook announced it was using blockchain

technology to create a cryptocurrency -- the world snapped to attention.Blockchain

A digital, distributed ledger which contains data for all the transactions that have ever taken place using a given cryptocurrency.Blockchain was no longer an overhyped buzzword. No, if a company like Facebook is developing and distributing a cryptocurrency on a blockchain -- then there must be something substantial to this new technology.

At the very least, Libra got people curious. At the most -- it inspires mass adoption, and a new financial era to come.

Instead of crumpled $20 bills lost in the washing machine and heavy gold locked up in a safe -- we may have digital Libra-like coins for payments and digital-gold types of currencies like Bitcoin.

We’re moving fast into the digital world -- it makes sense that our currencies are too.

- Own a website? Link to this article!

- Willing to spread the love? Share it on social!